I didn’t add any symbols to the watchlist this week, but we have 14 new signals in the idea generator on 12 different symbols … RIOT,ARE,ATGE,BBY,EC,FLOW,RIOT,BFR,CVI,DGRW,RIOT,ENTA,IHG,MGEN for review. All of which were all posted to the idea generator for our members to consider earlier in the week. Unsurprisingly RIOT showed up more than once, but you had to be pretty nimble if you were going to trade it intraday this week as lower highs, and lower lows were the trend. Price swings in crypto and some less than favorable assessments combined to make it an uphill battle for anyone long RIOT.

In terms of items making frequent appearances on my screens I have… BBY, BFR, CVI, EBIX, EC, LULU, AAPN, CBT, GSIT, IO, KND, LNCE, RFP, TCCO, TELL, WTTR, XIN.

In general, watchlist positions continue to fare favorably, and I’ll be working on a more comprehensive year-end review of 2017 for an upcoming post.

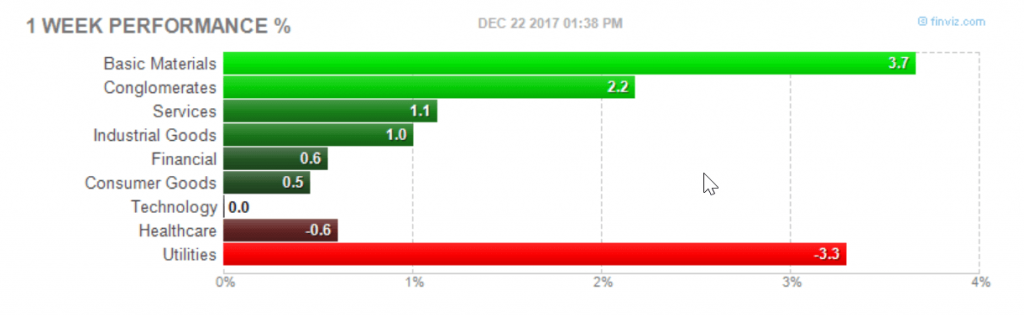

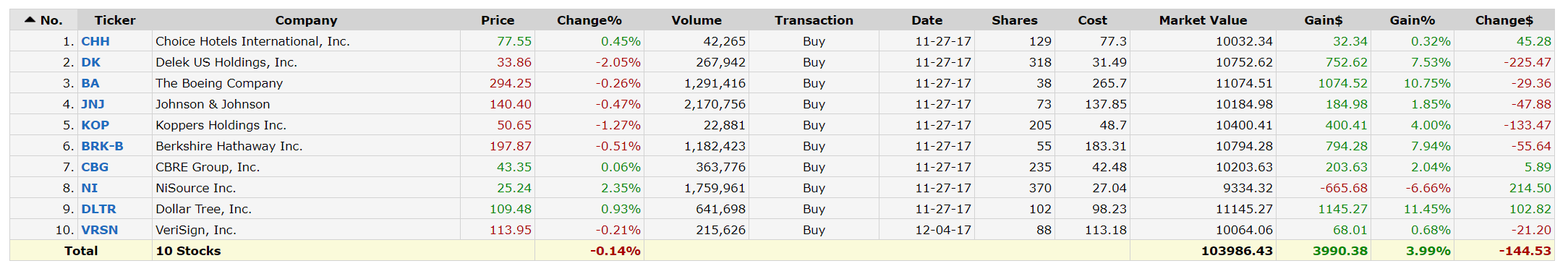

The semi-diversified rule-based model portfolio that we’ve tracking of late is up 3.99% since inception, which continues to compare favorably with the S&P over the same period at 3.07%. That said, the time-frame is not yet meaningful. As far as things to watch… check out BA which continues to be one of the year’s top performers – let’s see if there’s performance chasing from fund managers is enough to squeeze out a few more points before the end of the year!