During the past week, I added ESNT, L, PRA, MEOH to my watchlist, with 8 new symbols on the idea generator CACC, FIVE, ERI, DVY, RIOT, FNDC, AHH, XNET.

The following have been on my radar of late… ERI, FCFS, FII, BGC, BXMT, ITRI, LE, SCMP, WDAY.

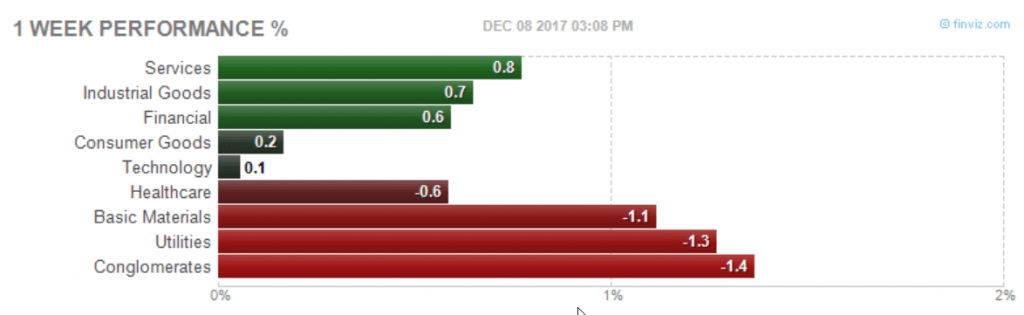

The S&P is down a bit on the week, opening Monday at 2657 , and we’re sitting here around 2651.60. On a sector basis, last weeks biggest winners extended their gains, while mixed action or weakness generally got weaker.

The S&P is down a bit on the week, opening Monday at 2657 , and we’re sitting here around 2651.60. On a sector basis, last weeks biggest winners extended their gains, while mixed action or weakness generally got weaker.

Looking at my recent watchlist additions, I’ve had a few noteworthy changes:

Above Targets: KELYA,BRK.B,

Between Targets: VRSN,BIDU,BA,MAS,CHH,ENV,AAPL,

Below Target 1: KOP,CNO,CTAS,HLT,SAIA,VAC,TOL,

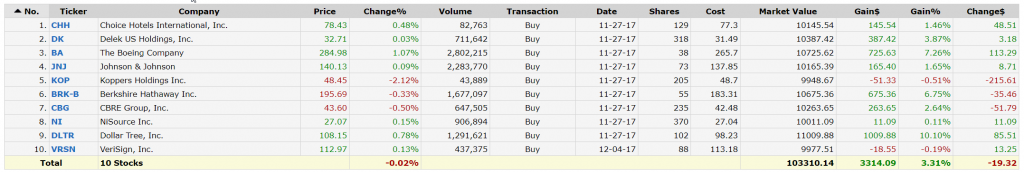

Turning to the model portfolio that I mentioned , VRSN replaced BIDU based on the rule-set I’ve been working on with negligible effect on the portfolio, save for sidestepping some BIDU volatility.

Since inception at the beginning of week 48, the model is up 3.31% vs. the S&P which is up 1.71% over the same timeframe.