I wanted to share a recent trade in HTHT.

China Lodging Group Ltd is a multi-brand hotel group in China. It provides training, reservation and support services to the franchised hotels. The hotel brands of the company include Joya Hotel, Manxin Hotel, Starway Hotel, HanTing Hotel and others.

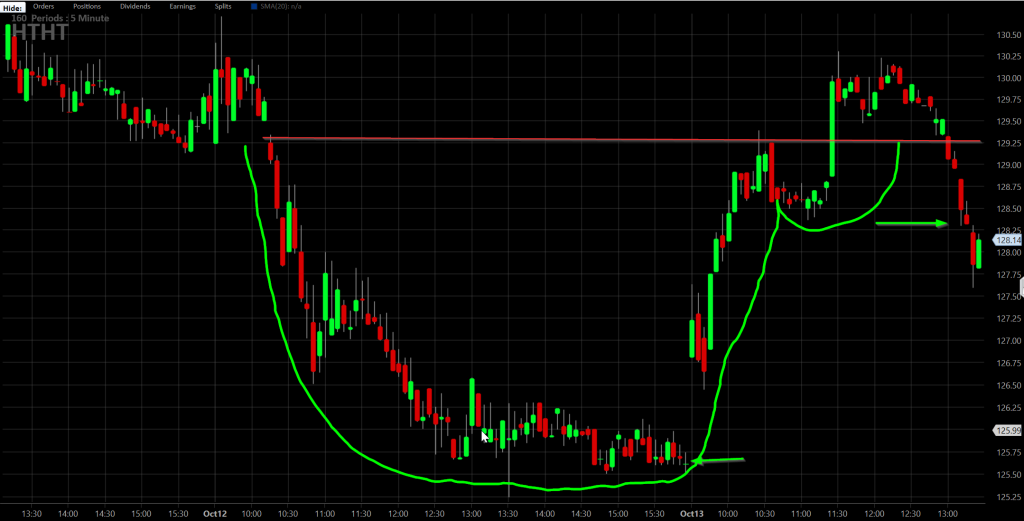

HTHT had been showing up on a couple of my screens recently, before reviewing it and adding it to one of my watchlists. After making a new high at 138.52, I was looking for a pullback to something approaching the 20-day moving average (see above).

After adding a price alert at 126, I entered a position on 10/12 near the lows of the day looking for a quick bounce. The stock opened up, and a potential cup-handle formation formed and I moved my stop up. After the sell off, I closed my position for a 2% gain.

A couple things… first of all, I could have better managed the trade, and probably should have set a profit target at 130.25 near resistance – given that I was really only looking to hold overnight. Bigger picture, as I mentioned in the tweet linked above, I continue to be on the look-out for an entry in a lodging position for my portfolio. While HTHT is interesting, and I had what looks like a reasonable entry here… this morning’s strength didn’t hold, and combined with the geopolitical risk in Southeast Asia I closed the position.

Bigger picture in the industry, one of the problems with the lodging plays I’ve been looking at – which has been true for a lot of what I’ve been looking at… is that it’s difficult to find an entry point with attractive risk/reward.