One of the things that I’ve been interested in doing is building a semi-diversified model portfolio, based solely on the output of my Earnings-Reminder watchlists and workflow. And I want to be able to measure it against the real-world S&P performance… and do so without adding anything to my work process beyond what’s available on the site, and the work I’m already doing.

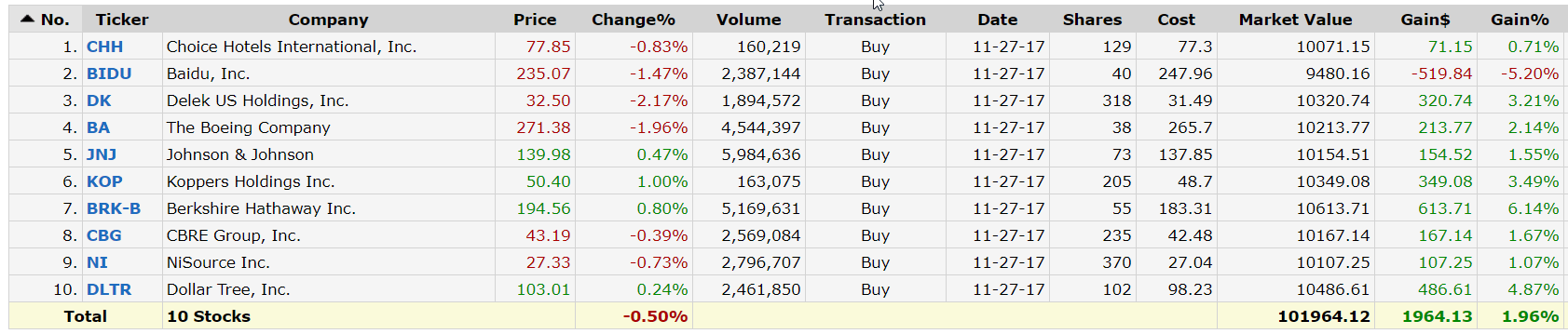

Here’s my first pass at a “generated” model portfolio.

Overview

In other words, here’s the work process…

- Starting with a few of the screens on the site, I review the output

- Next, I identify watchlist candidates on my prewatchlist

- Then, I review their charts in some greater detail in my trading platform and…

- Come-up with positions for my watchlists which include trade-to targets

- Finally, using the trade-to targets, the weekly watchlist report that gets generated updating position favorability

Given adherence to the above workflow, there’s enough information being captured to generate ideas for each sector. Then, based on how those symbols trade, there’s enough information to score those symbols and come up with model portfolio candidates using a rule-set or a voting algorithm. There’s probably even enough being captured that new positions can be elected and replaced based on changes in price, though there’s not enough here to address changes in market tone, so there’s probably a need to use the S&P as a barometer.

Regarding performance, the above model was built before the week started, so effectively it’s 1-week of performance. For what it’s worth, it closed the week up 1.96%, which compares favorably to the S&P which was up 1.49%. The only loss was the BIDU position, for which there was a couple of other positions with less risk (probably), that had very similar favorability (and therefore, the rules need to be tweaked a bit).

Anyway, this is just food for thought at this point. Please don’t expect weekly updates to the model, as I don’t have a way to automatically manage this at this point.