Here’s a quick update for week 14. I have 7 new watchlist additions this week that may be worth looking at. I also wanted to highlight EL, which keeps showing up screens, and seems to be holding up well during pull-backs. While it doesn’t fit my typical criteria for a watchlist addition, it continues to be a strength begats strength situation, and continues to trade higher and hold up well during pullbacks.

This weeks watchlist additions: MSA, ECL, WSO, ZUMZ, FIVE, FND, ASGN

Idea generator additions: LFIN, BURL, CHT, QHC, PFNX

Appearing more than 2 times in the last week on screen 1: MOV, TSLA

Repeats on the 52-week high screen for the past 2 weeks: BURL, CHT, CKH, CROX, EL, QDEL, QHC

Despite the recent sell-off, the watchlist continues to fare pretty well with the below positions continuing to be profitable relative to when they were added to the idea generator.

Above Watchlist Targets: KELYA,VRSN,BA,BRK.B,ABCD,

Between Watchlist Targets: BIDU,CHH,SAIA,MLCO,DK,CBG,ENV,AAPL,MEOH,DPZ,

Below Target 1/Above init: MAS,HLT,EMR,VAC,L,CR,TPR,EGN,

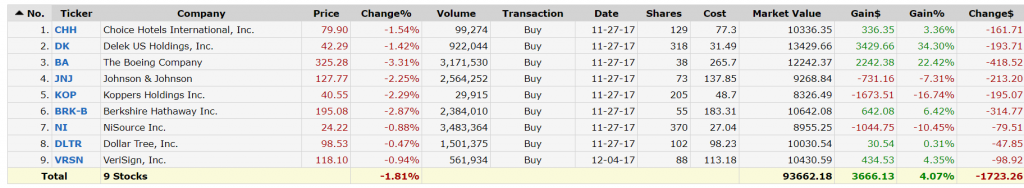

Checking back in on the November model portfolio, and it looks like it continues to outperform the S&P despite not having actively managed it, with it up 4.07%, relative to the S&P which is essentially unchanged here at 2607 vs. 2602 on 11/27/17. I remain interested in the generated portfolio concept outlined in the link above, but haven’t been able to give it the appropriate attention.